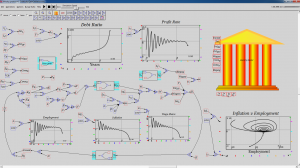

As regular readers here know, the main reason for developing Minsky was to make it possible to build monetary models of the economy. But it is also a pretty good tool for doing standard system dynamics modeling too, and in these two videos I show a range of famous chaotic oscillators modeled in Minsky:

Youtube Video of the four models

Building the Lorenz model in Minsky

Here are the source files if you’s like to run them yourself on your own, but first download the latest version of Minsky from here PC (or Mac).