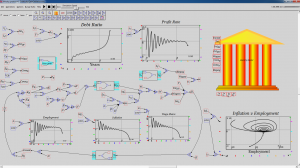

Readers with long memories will recall Paul Krugman describing interest in the history of economic thought as “Talmudic scholarship” (see figure 1), and dismissing it with an emphatic “I Don’t Care”.

“So, first of all, my basic reaction to discussions about What Minsky Really Meant – and, similarly, to discussions about What Keynes Really Meant – is, I Don’t Care,” Krugman said in 2012. “I mean, intellectual history is a fine endeavor. But for working economists the reason to read old books is for insight, not authority; if something Keynes or Minsky said helps crystallise an idea in your mind – and there’s a lot of that in both mens’ writing – that’s really good, but if where you take the idea is very different from what the great man said somewhere else in his book, so what? This is economics, not Talmudic scholarship.”