In a (for me!) brief presentation with 7 slides, I explain why rising private debt necessarily causes increased inequality, and leads to an economic crisis when the rate of growth of debt exceeds the rate of decline of wages as a share of national income. Crucially, the actual breakdown is preceded by an apparent period of tranquility–a “Great Moderation”.

This was a short talk to a public audience at ESCP Europe in Paris, which was presented in English and also translated into French by Gael Giraud, Chief Economist of the French Development Agency and the translator of Debunking Economics (so the soundtrack is in both English and French).

Click here for the Powerpoint file

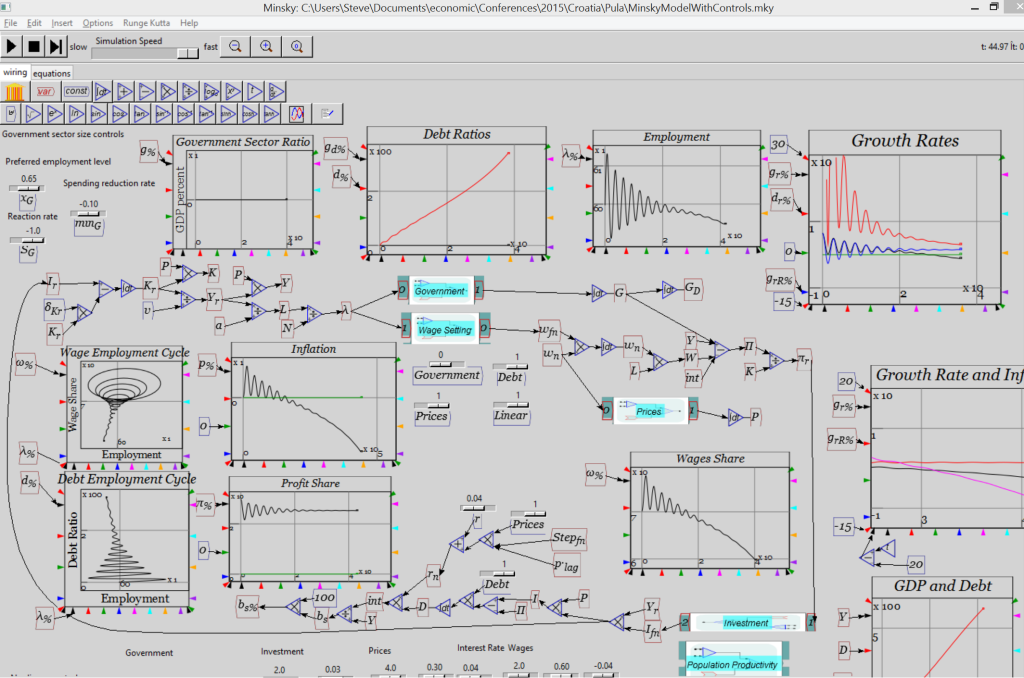

Right-click here to download a Minsky file that has controls for (a) linear or nonlinear functions; (b) Existence or not of debt; ( c ) Prices or a non-price model; (d) Existence of government; and (e) the capacity to control the level of employment of the population that the government is happy with (set at 65% initially).

You can download Minsky from here and you can make a donation to assist the development of Minsky here:

Here’s a sample simulation of the debt-inequality-crisis process from the Minsky file linked above: