Minsky: Latest News

Russell Standish has been working on Minsky thanks to the extra funds raised by the donate button below.

He has produced a beta which is a substantial improvement over the release version currently on the Sourceforge home page. It adds:

- an equation viewer–so you can design a model and instantly see the equations behind it from within Minsky (as well as export them to LaTeX);

- A differential operator, so you can calculate rates of change (and in typical Russell style, this is no ordinary numerical approximation but a full symbolic differential system, so the approximation problems that apply with (to my knowledge) all other system dynamics program differential operators don’t apply to Minsky);

- A large number of bug fixes.

With the caveat that beta versions almost always have bugs, this version is very close to a new release candidate and I would recommend using it rather than the stable release:

Keep Russell Standish coding Minsky

Minsky has been developed thanks to two grants: an initial US$128,000 grant from INET, and crowdfunding of $78,000 from Kickstarter. With other amounts from individual donor, that has funded about 2500 hours of programming by the brilliant programmer behind Minsky, Professor Russell Standish. I will be applying for other grants now that I am based in the UK, but in the meantime more funding is needed to keep the development rolling and to reserve Russell’s skills for Minsky. So please donate via the Paypal link above: the funds go directly to Russell, and the money raised so far–about $8,000–has helped produce the latest beta, which

SourceForge Project of the Month for January 2014

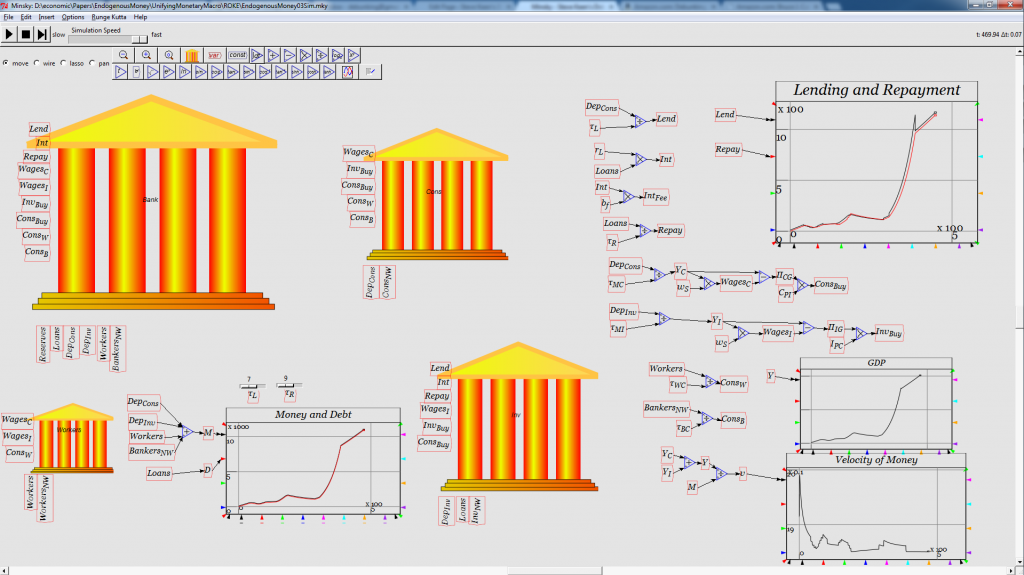

We’re delighted that SourceForge has seen fit to make Minsky it’s Project of the Month. Minsky is both a general purpose system dynamics program, and the first such program specifically designed to support the building of monetary models of the economy.

Our design objective has been to make it as intuitive as possible to use, while supporting various advanced features–such as maintaining consistency between multiple monetary flow tables–in as seamless a way as possible. We hope that users will find it useful, and we would be delighted to get coding assistance from developers, user assistance in bug testing and building the help system, etc.

Dr. Russell Standish and I have been working on Minsky now for almost two years now–first using a $125K from INET’s Spring 2011 grant round and then another $80K from a successful Kickstarter campaign: Russell as builder (coding in C++ and Tcl/Tk) and me as architect (playing with each release, spotting bugs and suggesting features). It’s been a part-time endeavor: Russell, as a contract programmer, has to keep more than one iron in the fire, while I have a fair few balls in the air myself. Russell has put in about 2000 hours of coding over that time.

That amount of coding is chicken feed compared to the millions of hours that have gone into a standard commercial product like Microsoft Word or Excel, so Minsky is still rough at the edges, and lacks a number of features that you would expect in a commercial package. But there is enough core functionality and stability in place for a first major release–the “Mun” version which can now be downloaded from SourceForge (major iterations of Minsky are named after major thinkers in economics–we started with Aristotle).

There is still only a rudimentary and incomplete Help file (did I say I had too many balls in the air?), so to make up for it I’ve recorded the following set of 15 videos that cover most of the features of the program. They’re all up on YouTube (where the number is the series changes from 8 to 11 to 15…), but here they are for easy reference, with some notes about what each video covers. All the Minsky (mky) files used in the presentations are in this Zip file.

So if you’re into economic modeling and you’d like to develop dynamic monetary models, Minsky now has enough features to be worth using–and it won’t face the limitations that apply to more conventional system dynamics programs, like Stella, Vensim, Vissim, etc., that make it inherently challenging to model the financial system. With Minsky and its Godley Tables, monetary modeling is a cinch (and it will get easier as we add more capabilities to the program). So please, download the program, join our beta-testing group, and start building monetary macroeconomics.

If you’re a developer with time to devote to this project, immediate needs include:

- Sprucing up plots;

- Copy and paste support files;

- Multiple files open at once;

- Building a LaTeX viewer into Minsky;

Medium term needs include:

- A direct LaTeX editor with seamless transfer between the equation pane and the canvas pane;

- Adding Social Accounting Matrix support for equation consistency checking;

The long term objectives include:

- Transform a “scalar” economic model into a “vector” with monetary and physical input-output dynamics with one click;

- Multiple economy support with financial and physical flows between economies, currency conversion, etc.;

- Data importing, manipulation and nonlinear parameter fitting

Minsky 1.0 Demo #1 Basics And Godley Table

Installing Minsky from a ZIP file, the canvas, wiring to build equations, installing a graph, graphing a basic function like sin(t), outputting the equations to LaTeX (which you can import into MathType in Word), and a basic “endogenous money” Godley Table.

Minsky Files: sine.mky (using Minsky to plot a sine wave); Godley.mky (a basic purely monetary model, with no simulation–just the double-entry bookkeeping table).

Minsky 1.0 Demo #2 Godley Simulation

Using a Godley Table to define a numerical simulation: right-click to copy flows and variables (“stocks”), defining monetary equations, and running a simulation.

Minsky file: GodleySim01.mky (the same model as in the previous video with definitions of flows added so that it can be numerically simulated).

Minsky 1.0 Demo #3 Godley-Goodwin Integration

Using time lags, entering Greek characters and subscripts, building a dynamic model using the flowchart part of the program, using integration blocks in dynamic models, making x‑y graphs as well as graphs of variables against time.

Minsky file: GodleySim02.mky (the same model as in the previous video, but using time constants rather than arbitrary numbers for system parameters); GodleyGoodwin01 and GodleyGoodwinSim01 (adding a Goodwin model of production using the flowchart aspects of the program, and adding XY charts, slowing down the simulation speed)

Minsky 1.0 Demo #4 Godley-Goodwin Integration

Starting to integrate a monetary and a physical model, using sliders to vary parameters during a simulation.

Minsky files: GodleyGoodwinSimInt01 (beginning to integrate the two models: making the wage a monetary phenomenon)

Minsky 1.0 Demo #5 Godley Goodwin Integration #2

Doing it right: starting by modifying the real cyclical model to include monetary variables.

Minsky files: GodleyGoodwinSimInt01C (adding Price to the Goodwin model before attempting the integration).

Minsky 1.0 Demo #6 Godley-Goodwin Integration

Continuing the process.

Minsky files: GodleyGoodwinSimInt01D (completing the integration)

Minsky 1.0 Demo #7 Godley-Goodwin Integration #4

Continuing the process.

Minsky files include GodleyGoodwinSimInt03, where I add a linear investment function to the linear wage change function that is the core of the Goodwin model.

Minsky 1.0 Demo #8 Godley-Goodwin Integration #5

Getting cycles in the monetary economy as well as the physical. Introducing an investment function as well as a wage change function. Showing the debt-deflation model.

Minsky files include DebtDeflation02, which is the monetary version of my 1995 debt-crisis model in “Finance and Economic Breakdown”

Minsky 1.0 Demo #09 Multiple Godley Tables

Combining MMT and MCT with two Godley Tables, one for the Central Bank, the other for Private Banks. Minsky’s built-in logic to maintain consistency between assets and liabilities across multiple Godley Tables. A potentially surprising result about the relationship between the change in private debt and the change in public debt.

Minsky files: MinskyOnePointZeroDemo09MultipleGodleyTables (combines MMT and MCT and shows that the change in private debt and the change in public debt are not of equal and opposite magnitudes in a closed economy).

Minsky 1.0 Demo #10 Zooming

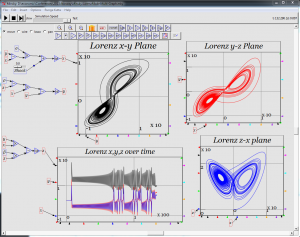

Grouping entities, zooming in to see a group, editing a group, using the Lorenz Strange Attractor as first example, and my model of debt-deflation as the second.

Minsky 1.0 Demo #11 Bugs

Bugs and how to cope with them.

Minsky 1.0 Demo #12 Lorenz model

Using the flowchart side of the program to build the famous Lorenz model. Changing the Runge-Kutta parameters to get a smoother simulation. Setting ranges on a graph.

Minsky 1.0 Demo13 # Lorenz model with Sliders

Using sliders to vary parameters in a model while it runs.

Minsky files: Variations on Lorenz, especially LorenzWithSliders02.

Minsky 1.0 Demo #14 Competitors

How does Minsky stack up as a system dynamics program compared to the established players Simulink, Vensim, and Vissim? It doesn’t have the power of these established programs of course–matching the feature set of even Vensim would require tens thousands more hours of programming time, let alone that of Vissim or the market leader Simulink. But on a user-friendliness scale, I think it’s easy to see that Minsky is much easier to use than Vensim, significantly easier than Simulink, and within reach of Vissim–though it lacks some basic editing features.

Minsky 1.0 Demo #15 Why Godley Tables?

This is the clincher. If you want to model monetary dynamics, there is no other program that offers anything like the Godley Table for modeling the double-entry flows that characterize the financial system. A flowchart is an inherently weak tool for building a monetary model..