My talk at the Canadian Centre for Policy Alternatives was attended by an interesting eclectic bunch, with possibly the most eclectic of all being Genevieve Tran, who publishes the “Money Big and Small” blog. She asked me about financial literacy, I replied that the concept, like so much in economics, has been made nonsense of by neoclassical economists, and the conversation continued on from there.

This is her record of the evening. For more of Genevieve’s writings, check out her blog (she warns me there’s an approaching “Galileo Plays Frisbee” followup).

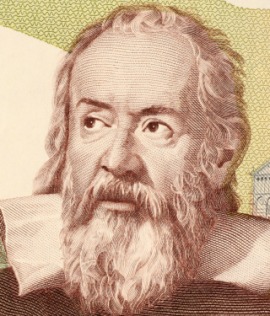

The other Thursday, I ended up at a pub with Galileo. Yes, the pre-eminent 17thcentury Italian astronomer who died while under extenda-remix house arrest by the Catholic Church for being…right. Yes, THE Galileo who has since been universally un-begrudged; converting through the vision of his telescopes, every last flat-earthling.

The other Thursday, I ended up at a pub with Galileo. Yes, the pre-eminent 17thcentury Italian astronomer who died while under extenda-remix house arrest by the Catholic Church for being…right. Yes, THE Galileo who has since been universally un-begrudged; converting through the vision of his telescopes, every last flat-earthling.

He appeared to me as a ghost. Here he is sitting across the table at the Wolf and Firkin in Toronto, a halo of white all around his head. Oddly, of all things, he spoke with an Australian accent. Between cheekfuls of sweet potato fries and house salad, we discussed Norwegians, reality TV, the state of fast fashion, and the economy. Yup. It was 28 degrees on a Toronto summer patio, just shooting the shit with One of the World’s Most Eminent Heretics. ?!?!??!?!?!??!?!?

He appeared to me as a ghost. Here he is sitting across the table at the Wolf and Firkin in Toronto, a halo of white all around his head. Oddly, of all things, he spoke with an Australian accent. Between cheekfuls of sweet potato fries and house salad, we discussed Norwegians, reality TV, the state of fast fashion, and the economy. Yup. It was 28 degrees on a Toronto summer patio, just shooting the shit with One of the World’s Most Eminent Heretics. ?!?!??!?!?!??!?!?

wlu-wlu-wlu-wlu-wlu

(uh, this is a record rewind sound in case you’ve never seen it in print!)

Some of you may be able to identify this figure as Dr. Steve Keen from the University of Western Sydney (now riding Toronto’s public transit). He’s a Professor of Economics. What he does has nothing to do with religion: scripture interpretation, the centre of the universe, dogma, heresy etc. But, strangely enough, he’s found himself right back in the 17th century where the Pope of That’s Who Says So in Economics, wishes Dr. Keen would just lock himself up in his house and never come out again. But here he is in Toronto, doing some mathematical work in June 2012, all the way from Oz and he didn’t even fall off the edge of the earth.

Some of you may be able to identify this figure as Dr. Steve Keen from the University of Western Sydney (now riding Toronto’s public transit). He’s a Professor of Economics. What he does has nothing to do with religion: scripture interpretation, the centre of the universe, dogma, heresy etc. But, strangely enough, he’s found himself right back in the 17th century where the Pope of That’s Who Says So in Economics, wishes Dr. Keen would just lock himself up in his house and never come out again. But here he is in Toronto, doing some mathematical work in June 2012, all the way from Oz and he didn’t even fall off the edge of the earth.

So, I’m not being entirely abstract. Dr. Keen IS a ghost of sorts—many in the field of Economics like to pretend he doesn’t exist. These include certain Nobel-Prize-Laureate-disciples and his own Australian government. But at the same time, ghost-hunters like the Canadian Centre for Policy Alternatives, BBC, University of Oxford and the Fields Institute in Toronto (U of T) have been happy to have him haunt them from time to time to chat and work on stuff. So, why is it that Dr. Keen is so annoyingly living up to his name, according to many?

Let me quote him from a few hours before the fries and salad:

“I’m doing my best to eradicate [the NeoClassical economists who dominate the field]…The reason they didn’t see this [prolonged world debt] crisis coming is that they leave banks, debt and money out of their [mathematical] models. Now I know when I say that to a non-economist, the reaction is ‘Huh?, you’ve got to be kidding! They’re economists! Of course they know about debt, banks and money’ and I say, ‘no they don’t, they left them out of their models so they couldn’t have possibly seen a crisis caused by debt, banks and money even coming.’”

This was the off-putting pitch Dr. Keen started with during his talk earlier at the Arts and Letters Club on Elm St. And clearly, Dr. Keen isn’t half as nice as Galileo (the latter who tried to compromise with his oppressors to say that his science debunking the God-created-world-as-centerpiece doesn’t have to be at odds with scripture). Dr. Keen quoted Max Planck quite frankly that “Science progresses one funeral at a time” (not to say that Economics is a science).

I hadn’t known of him really before this talk. A friend in Tokyo had urged me to go and upon googling it, I learned that Dr. Keen was THE guy in the world who proved all this economic crisis stuff would go down exactly as it has gone down, way back in 2005 (and not with divining sticks, but with MATH y’all). However, I RSVP’d on the strength of the open bar and free cheese. Powerful lures.

Back to the snake oil. Obviously, it is dismaying to hear that in this day and age, we can’t turn our backs for a second, while we go about our daily work, and dare entrust the levers of Pretty Important Shit to blue-ribboned economists to do their job—which is to steer our economy away from doom–because they are sleeping on the job!! So, if for even plebes like me it is OBVIOUS to factor in banks, debt and money when trying to figure out how the economy behaves, how could it ever possibly escape the stratospheric brainpower of Zeus?? Dr. Keen must be lying!

(Good god….he’s not. 🙁 )

Dear Dr. Keen,

If what you are saying is true, I want to know: to what extent is this assuming away (i.e. not including the factors of ) “debt, banks and money” done when planning whole countries’ economies by eggheads?? What do you mean “NeoClassicists” who think this kind of thing dominate the field? How is it possible that dude after dude in Economics (gender equality aside, I can’t imagine any woman would want any inclusion in this) can cartel-style leave out such common-sense intuitive / real-ass factors such as:

- bankers are rewarded based on the size of loans they are able to peddle to borrowers

- they actively hot-sell more expensive mortgages than people can really afford to achieve their rewards; this actively drives up the prices of houses (because for crissakes, what else would ever cause some of these Chinese thumb traps in Toronto to go for $750,000?!??!); and doesn’t this just serve to expand the size of loans/mortgages (=more rewards) to peddle in the future?

- when people are in debt, many of them (who are responsible) won’t want to borrow any more money

- when people are in debt, many of them don’t feel like shopping

- and if they do (say, for necessities), it worsens their predicament of debt (= debt is dangerous)

- bailing out banks so that they will have more money to lend to the public (=creating more debt) as an answer to the economic crisis of debt does not make sense on a personal, micro level (so, how does it on a macro level without it perpetuating a death spiral?)

I wonder what there is to gain by overlooking such huge warning signs en masse as economists?

1. Comradery?

2. Is being a dissenting economist a scary and lonely thing?

3. Is there schoolyard bullying, in the field of Economics if you don’t so much as wear your pocket-protectors the same way?

4. Is there really a Pope of Economics that one shouldn’t cross? (I thought I was just kidding)

5. Will economists lose funding if they don’t say what they’re paid to say?*

*To this end, are economists really only worried about their own personal economy rather than the one shared by the rest of us?

Dr. Keen, your presentation included a lot of nasty, eye-crossing math, which didn’t have the effect of convincing me (not entirely your fault: 2 glasses of red wine + derivatives – all I ever learned in undergrad Econ = 0):

(…and some seriously unrhythmic hyphenations)

And I’m sorry I squandered our conversation at the pub afterward on how reality TV is surely a sign of the world ending. (You may have had a slightly more compelling anecdote…). I shall have to track you down to make you speak English to me, Aussie accent notwithstanding.

Your plebe and trusty economic serf-girl,

Genevieve

* * *

It is too hot right now (32 degrees, plus my MacBook is burning up) for me to dig into all this now. But, it’s horrible to think that there are people out there who are hired by governments (i.e. us taxpayers) to consult about where to go with the economy, who are ^%&*# or just frickin’ *&^&%%$#@.

Kim Kardashian at least lays bare every last sordid secret, every week!

I’ll be watching you Dr. Keen!

(I guess you’re watching us too!)

FYI, Galileo’s middle finger is on display at the Museo Galileo in Florence (surely awaiting certain individuals…who then probably wouldn’t get it anyway).