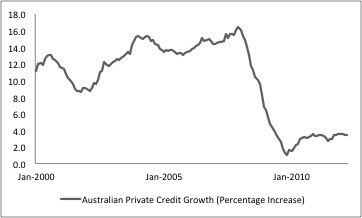

The lack of expansion in the Australian private credit markets is certainly having an adverse effect on commerce in the post 2008 financial crisis period. Annual private credit growth has averaged 3.5%, since it dropped down to single digit figures in October 2008.

Personal credit and business credit have been the deadweight’s, averaging an annual growth of ‑1% and ‑0.5% respectively. Housing credit has offset this with an average annual growth rate of 6.9% since October 2008. However, this has since slowed to an average annual rate of 5.3% for the first 3 months of this year and is continuing on this slowing trend. With significantly less credit coming into the market, the Government have had no choice but to compensate deficit spending.

Though, as pointed out in last week’s blog post Inflation or Noflation, the ALP has recently embarked on a mission of austerity to please the big rating agencies.

| Date: | Government Securities on Issue (AU$ Millions) |

|

Jan-2012 |

221646 |

|

Feb-2012 |

229706 |

|

Mar-2012 |

236036 |

|

Apr-2012 |

227126* |

*As at the 27th April 2012

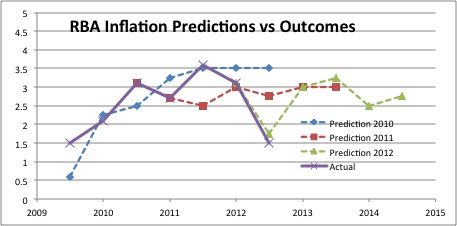

This leaves increasingly fewer options to maintain a path of economic growth here in Australia. The deterioration in credit growth has forced the RBA to revise their already revised economic outlooks. The following graphs review the RBA’s predications versus the actual outcomes for both growth and inflation.

While the accuracy of these outlooks is debatable, the precision of their recent 2012 prediction for inflation has positioned the Bank well in justifying a 50 basis point reduction of the target cash rate on Tuesday 1 May. However, given the two 25 basis point reductions for November and December last year had no noticeable effect on credit growth, particularly housing credit growth, I would suggest this measure will too provide little effectiveness. And then, of course, there is always the question of how much the big banks will actually pass on with their increasing funding costs. NAB have so far been the first, passing on 32bps.

With mining conditions deteriorating, house prices falling, Government austerity measures, a struggling retail sector and lack of effectiveness through monetary stimulus, unfortunately the Australian economy has nowhere to grow.