If the economy does in fact recover from the Global Financial Crisis—without private debt levels once again rising relative to GDP—then my approach to economics will be proven wrong.

But this won’t prove conventional neoclassical economic theory right, because, for very different reasons to those that I put forward, modern neoclassical economics argues that the government policy to improve the economy is ineffective. The success of a government rescue would thus contradict neoclassical economics just as much—or maybe even more—than it would contradict my analysis.

The actual reasons for this belief are arcane, but this choice quote from leading neoclassicals Thomas Sargent and Neil Wallace puts the dominant neoclassical case in a nutshell:

In this system, there is no sense in which the authority has the option to conduct countercyclical policy. To exploit the Phillips Curve [a relationship between unemployment and inflation], it must somehow trick the public. But by virtue of the assumption that expectations are rational, there is no feedback rule that the authority can employ and expect to be able systematically to fool the public. This means that the authority cannot expect to exploit the Phillips Curve even for one period. Thus, combining the natural rate hypothesis with the assumption that expectations are rational transforms the former from a curiosity with perhaps remote policy implications into an hypothesis with immediate and drastic implications about the feasibility of pursuing countercyclical policy.’ (“Rational Expectations And The Theory Of Economic Policy”, Journal of Monetary Economics, Vol. 2 (1976) pp. 177–78; emphases added)

The neoclassical confidence that the government can’t beneficially affect the economy is thus based on the insane assumption of “rational agents” who live in a world that is permanently in equilibrium, and whose expectations about the future are accurate—something that Ross Gittins’s recent column did a good job of critiquing. The real world is inhabited by real, fallible human beings, who are prone to bouts of irrational exuberance, susceptible to Ponzi Schemes disguised as investment, and who live in a world in permanent disequilibrium and with an uncertain future, in which their expectations are almost always wrong. They are therefore incapable of predicting and therefore neutralizing the impact of government policy, as neoclassical theory assumes that “rational agents” do.

There are other strands in neoclassical theory that argue there is some role for the government in controlling the economy—notably the so-called Taylor Rule which argues that the Central Bank can control the economy by fine tuning the interest rate. Taylor himself is arguing that deviation from his rule—when the Federal Reserve under Greenspan held interest rates at near zero after the burst of the DotCom bubble in 2000 – is what caused the crisis. I disagree, but that’s a topic for a later day.

The general proposition remains that in its overall bias, neoclassical theory argues that the government can’t beneficially influence the economy—and therefore that if there is a genuine, sustainable recovery as a consequence of the government stimulus packages, that contradicts neoclassical economics even more than it would contradict my approach.

That means that if there is a “winning” economic theory out there, then it must be one that argues that government action alone can help an economy recover from a crisis, and indeed maintain output growth at a level that will maintain full employment.

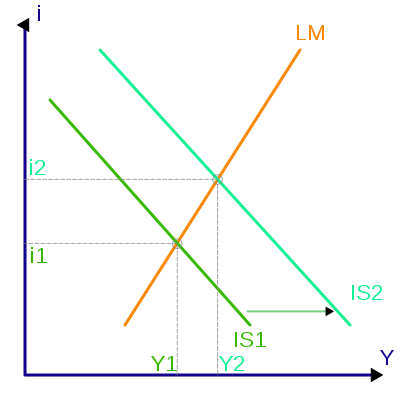

There is one “neoclassical” theory that argues this, which most economists—reflecting their non-existent training in the history of their own discipline—actually think is Keynesian. This is the so-called “IS-LM” model, which argues that the government can manipulate employment via fiscal policy. Neoclassicals are likely to retreat to this model—and declare themselves “Born Again Keynesians” in the process—without realizing that the originator of this model, John Hicks, rejected it on very sound grounds almost 30 years ago.

Hicks realized that his model attempts to represent the economy using just two markets—goods and money—when there is of course another important market: that for labour. He omitted the labour market from his model on the basis of what neoclassical economists call “Walras’ Law”. This is the proposition that, if all but one market in an economy are in equilibrium, then that final market must also be in equilibrium.[1]

Writing in 1979 in the non-orthodox Journal of Post Keynesian Economics, Hicks realized this flaw (and several others) in this logic: it can apply only when the economy is in equilibrium—when both the goods market AND the money market are in balance. That, in terms of the model, is where the two curves cross. But the model is used to simulate what is supposed to happen when one or both markets are not in equilibrium, or when one curve—normally the IS curve—is shifted by deliberate government policy, such as running a deficit during an economic crisis. Therefore it is used to try to describe what happens in disequilibrium.

But in disequilibrium—anywhere on the diagram apart from where the two curves cross—Walras’ Law can’t be used to ignore what’s happening in the labour market. So even working from Hicks’s model, neoclassical economists would need to consider disequilibrium dynamics of 3 or more markets. Hicks damningly concluded that:

the only way in which IS-LM analysis usefully survives — as anything more than a classroom gadget, to be superseded, later on, by something better — is in application to a particular kind of causal analysis, where the use of equilibrium methods, even a drastic use of equilibrium methods, is not inappropriate. (Hicks, J. 1981, ‘IS-LM: An Explanation’, Journal of Post Keynesian Economics, vol. 3, no. 2, p. 152; my emphasis)

Yet as Gittins pointed out, and as Paul Krugman himself recently confirmed, neoclassical economists are so obsessed with equilibrium methods that they will shy away from thinking in disequilibrium terms. As Krugman put it, right after critiquing neoclassical economics for being braindead, “I, for one, am not going to banish maximization-and-equilibrium from my toolbox”.

I’m sorry Paul, but stick with those tools and you’ll never come to grips with Minsky’s Financial Instability Hypothesis, let alone the actual disequilibrium dynamics of the real economy.

So there is no coherent neoclassical theory that can take solace from the success of the government stimulus packages, should they avert a deep recession and cause a sustained recovery without a rise in the private debt to GDP ratio.[2] If there is to be a winner in this debate, it has to be a non-neoclassical school of thought.

There is such a school of thought which has developed in Post Keynesian literature recently. Known as Chartalism, it argues that the government can and should maintain deficits to ensure full employment.

Chartalism rejects neoclassical economics, as I do. However it takes a very different approach to analyzing the monetary system, putting the emphasis upon government money creation whereas I focus upon private credit creation. It is therefore in one sense a rival approach to the “Circuitist” School which I see myself as part of. But it could also be that both groups are right, as in the parable of the blind men and the elephant: we’ve got hold of the same animal, but since one of us has a leg and the other a trunk, we think we’re holding on to vastly different creatures.

That said, I do have numerous issues with the Chartalist approach, but I haven’t studied its literature closely enough yet to write a critique. [3] I also could have distorted their arguments if I had attempted a summary of their views. So what I decided instead to do is to ask a leading Chartalist, Professor Bill Mitchell from the University of Newcastle, to write a précis of the Chartalist argument (Bill also has a blog on this approach to economics).

This précis follows. I emphasise in closing my own comments that, if there is a genuine recovery not involving rising private debt to GDP levels, then Chartalism is the only theory left standing. Neoclassical economics is dead.

The fundamental principles of modern monetary economics, By Bill Mitchell, Professor of Economics, University of Newcastle

The following discussion outlines the macroeconomic principles underpinning modern monetary theory (sometimes referred to as Chartalism).

The modern monetary system is characterised by a floating exchange rate (so monetary policy is freed from the need to defend foreign exchange reserves) and the monopoly provision of fiat currency. The monopolist is the national government. Most countries now operate monetary systems that have these characteristics.

Under a fiat currency system, the monetary unit defined by the government has no intrinsic worth. It cannot be legally converted by government, for example, into gold as it was under the gold standard. The viability of the fiat currency is ensured by the fact that it is the only unit which is acceptable for payment of taxes and other financial demands of the government.

The analogy that mainstream macroeconomics draws between private household budgets and the national government budget is thus false. Households, the users of the currency, must finance their spending prior to the fact. However, government, as the issuer of the currency, must spend first (credit private bank accounts) before it can subsequently tax (debit private accounts). Government spending is therefore the source of the funds the private sector requires to pay its taxes and to net save, and it is not inherently revenue constrained.

So statements such as “the federal government is spending taxpayers’ funds” are totally inapplicable to operational reality of our monetary system. Taxation acts to withdraw spending power from the private sector but does not provide any extra financial capacity for public spending.

As a matter of national accounting, the federal government deficit (surplus) equals the non-government surplus (deficit). In aggregate, there can be no net savings of financial assets of the non-government sector without cumulative government deficit spending. The federal government via net spending (deficits) is the only entity that can provide the non-government sector with net financial assets (net savings) and thereby simultaneously accommodate any net desire to save and hence eliminate unemployment. Additionally, and contrary to mainstream economic rhetoric, the systematic pursuit of government budget surpluses is necessarily manifested as systematic declines in private sector savings.

We often read that the appropriate fiscal stance is to balance the federal budget over the business cycle. Some economists claim the goals should be to run a surplus on average over the cycle allowing for deficits in extreme downturns. Both goals would be fiscally irresponsible in Australia’s situation where our current account is typically in deficit. If the government balanced the budget on average and the current account deficit was in deficit over the business cycle then the private domestic sector would on average be in deficit (dis-saving) over that cycle. The decreasing levels of net private savings financing the government surplus increasingly leverage the private sector. The deteriorating debt to income ratios which result will eventually see the system succumb to ongoing demand-draining fiscal drag through a slow-down in real activity.

In other words, adopting a growth strategy that relies on increasingly leveraging the private sector is unsustainable. The only way the private domestic sector can save if there is a current account deficit is for the government sector to run deficits up to the desired private saving. Government deficits “finance” private saving by ensuring that aggregate spending is sufficient to generate the level of output and income that will bring forth the private desired saving levels.

Unemployment occurs when net government spending is too low. As a matter of accounting, for aggregate output to be sold, total spending must equal total income (whether actual income generated in production is fully spent or not each period). Involuntary unemployment is idle labour unable to find a buyer at the current money wage. In the absence of government spending, unemployment arises when the private sector, in aggregate, desires to spend less of the monetary unit of account than it earns. Nominal (or real) wage cuts per se do not clear the labour market, unless they somehow eliminate the private sector desire to net save and increase spending. Thus, unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

How large should the deficit be? To achieve full employment net government spending has to be equal to the non-government desire to net save to ensure there is no aggregate demand gap. Unlike the mainstream rhetoric, insolvency is never an issue with deficits. The only danger with fiscal policy is inflation which would arise if the government pushed nominal spending growth above the real capacity of the economy to absorb it.

If governments are not revenue constrained why do they borrow? We have to differentiate voluntary constraints governments impose on themselves (which reflect ideological dispositions) from the underlying mechanics of the banking system in a fiat monetary system.

In terms of the latter, while the federal government is not financially constrained it still might issue debt to control its liquidity impacts on the private sector. Government spending and purchases of government bonds by the central bank add liquidity, while taxation and sales of government securities drain private liquidity. These transactions influence the cash position of the system on a daily basis and on any one day they can result in a system surplus (deficit) due to the outflow of funds from the official sector being above (below) the funds inflow to the official sector. The system cash position has crucial implications for the central bank, which targets the level of short-term interest rates as its monetary policy position. Budget deficits result in system-wide surpluses (excess bank reserves).

Competition between the commercial banks to create better earning opportunities on the surplus reserves then puts downward pressure on the cash rate (as they try to off-load the excess reserves in the overnight interbank market). So budget deficits actually put downward pressure on short-term interest rates which is contrary to all the claims made by mainstream economics.

If the central bank desires to maintain the current positive target cash rate then it must drain this surplus liquidity by selling government debt. In other words, government debt functions as interest rate support via the maintenance of desired reserve levels in the commercial banking system and not as a source of funds to finance government spending.

However, the central bank could equally just pay the commercial banks the target rate of interest on all overnight reserves which would achieve the same end without the need to issue debt. So there is no intrinsic reason for a sovereign government to borrow to “finance” its net spending.

The reality is, however, that the neo-liberal era has forced the governments to adopt voluntary constraints on its fiscal activity which are tantamount to those that operated during the gold standard period.

So the federal government now issues debt to the private markets via an auction system $-for-$ with net government spending (deficits). This allegedly imposes “fiscal discipline” on the government (it is totally unnecessary from a financial perspective) because the rising debt becomes a political issue. In conclusion, much of the deficit-debt hysteria that defines the current macroeconomic debate is based on false premises about the way the monetary system operates and the financial constraints on government spending.

Modern monetary theory provides a sound basis for understanding the intrinsic opportunities available to governments in a fiat monetary system and exposes most of the constraints that are imposed on the conduct of fiscal policy as being of an ideological origin.

[1] I reject this argument, but again that’s a story for another day.

[2] There is one Neoclassical School that Krugman believes is validated by the success of the stimulus packages, so called New Keynesianism. Yet again I think that’s wrong, and yet again it’s a topic for another day.

[3] This critique by a Spanish academic indicates that Chartalism is disputed within the broad Post Keynesian school of thought; however I should note that some Chartalists regard this critique as a caricature of their views.

PS if you’d like this essay in PDF format, click here.